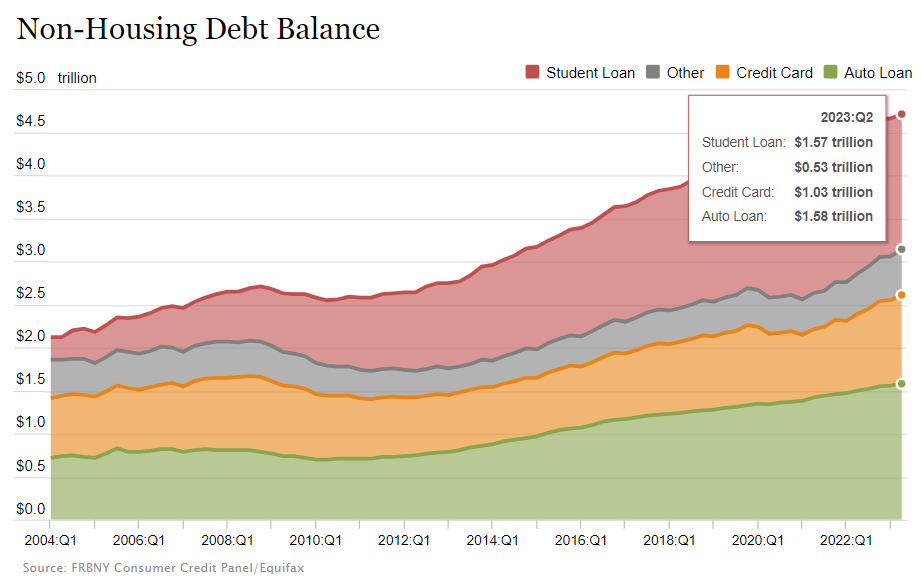

In less than a week, there’s another indicator that Americans have reached a milestone by accumulating $1 trillion in credit card debt for the first time. New data from the Federal Reserve Bank of New York reveals that outstanding credit card balances reached $1.03 trillion in the second quarter, up 4.6% from the previous quarter.

This surge in credit card debt indicates that more Americans are relying on credit over the past year, even though banks are being cautious about lending to risky borrowers. Despite challenges like higher interest rates, inflation, and bank failures, there’s no widespread financial distress among consumers, according to researchers from the NY Fed.

More credit card accounts were opened in the quarter, and the total credit limit also increased. While the delinquency rates for credit cards increased slightly, experts believe this is normalizing after being very low during the pandemic when government support helped people pay down debt.

Younger generations, especially those aged 18 to 29, had higher credit card delinquency rates. Subprime borrowers (higher risk of default) found it harder to qualify for credit this year due to tighter lending conditions by US banks. These trends could continue, making it even tougher for subprime borrowers to get credit.

As the student loan repayment pause ends, some Americans with credit card debt might be worried. However, new policies will make it easier for borrowers to handle student loan repayment. Monthly payments will be lower under the new income-driven repayment plan, and there’s a 12-month program to protect borrowers from severe consequences of late payments.

The NY Fed researchers won’t be able to track student loan delinquencies for the first year, but they might see if there are any effects on credit card delinquencies or other types of debt. Despite rising balances, household credit seems to be stabilizing, although with higher balances than before the pandemic.

TFC Team

thefirm.sg