Cyclical conditions around the world and mispricing in the markets

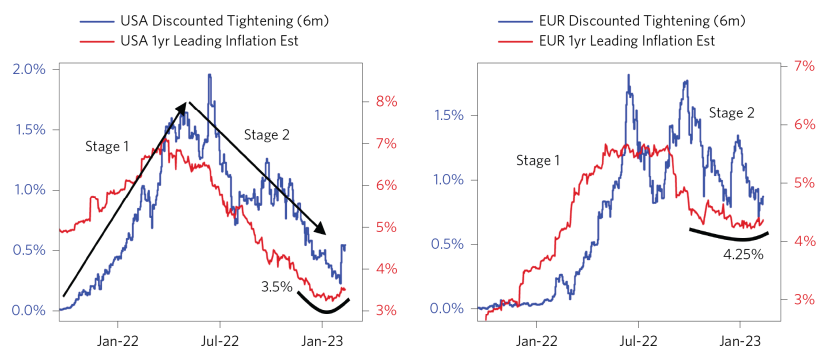

Let us start by saying that in many ways it’s going to be very, very difficult to achieve both strong growth and the low inflation that we have become accustomed to because all these inflationary forces are in the system. So what you are seeing now is a tug-of-war where the markets on the one hand are very pleased that growth does not seem to have slowed down yet – that growth has not slowed down yet despite the significant tightening, that things seem to be going relatively well, that the bubble is starting to burst in some of the most bubbly areas of the economy where a lot of the money that’s been printed over COVID has gone, without that having led to a significant weakening of the whole economy. Energy prices have calmed down somewhat. At the same time, there is also a flip side to the coin, because every time the economy is stronger and more resilient than expected, we experience what we see today, namely that inflation is not anchored at the level it once was. The bottom line is that we cannot get to 2% inflation. If we want to get back to 2%, it is not going to magically happen. It will take either much more economic weakness than we have seen so far or much more tightening to bring inflation down.

Most importantly, either of these options would be pretty bad for most portfolios. If monetary tightening is not yet complete and the economy weakens, that will be pretty bad for equities. And if further tightening is necessary because the economy will prove resilient, but we still need to lower inflation, that tightening to lower inflation will put significant negative pressure on all assets.

It is really a good time for us to take time out and come back stronger.

The biggest misjudgement in the markets today is the combination of markets. It is not a single market that is mispriced. Rather, it is that the different things that are priced into the different markets cannot coexist at the same time. So when you start valuing equities, the valuation of equities is more or less such that there will not be a significant slowdown in earnings or in the economy. You have already seen that profits are starting to fall and that has not been extrapolated to say that there is more ahead. Well, that may be true. That is possible. I think that would be very difficult to do because profits are even more sensitive than the economy. That’s why profits have already fallen even though the economy is still relatively strong, because of the kind of environment we had after COVID came out.

But let us assume that equity pricing is true. In that kind of environment, it seems almost impossible to imagine that interest rate pricing could be correct. After all, if earnings remain strong and the economy is not affected by a slowdown in the labour market or a slowdown in the economy, why would the Fed shift so quickly and ease monetary policy for a year or two, and relatively soon in this environment when inflation is as high as it is today? So if you look at the pricing of interest rates, it basically means that inflation is coming down to a completely normal level, that you do not have to worry about it and that the Fed can start easing relatively soon.

Now, if you raise interest rates, that could also be plausible, but that would only be plausible if the economy collapses. If the economy is very, very weak, then it seems quite plausible that inflation will continue to fall and the Federal Reserve would want to ease that relatively soon to prevent the weakness from compounding itself. So either market could well be right. But grouping these markets together seems like an implausible scenario because actors simply will not behave that way in response to the other market’s conditions.

That’s one of the great advantages of being an investor who looks at all global markets at once: you can find mispricings that are related to the general story that the markets are telling you across all the different valuations, and you can say, “If A happens, B can not happen, and vice versa.”

So what’s next? The debt crisis is still the thing we are looking at in the Dow Jones Index for 2023.

TFC Team

thefirm.sg